The Private Placement Life Insurance in the UAE

Private Placement Life Insurance (PPLI) is a life insurance policy which can hold a legal and beneficial interest in a range of assets such as financial assets, operating businesses and digital assets while allowing the policyholder (or its representatives) to retain a certain degree of influence and operational control of the underlying assets.

PPLIs are used as an estate and succession planning tool by high-net-worth families and can be utilised as alternative ownership structures to traditional trust and foundation arrangements.

How Does it Work and Who are the Parties Involved

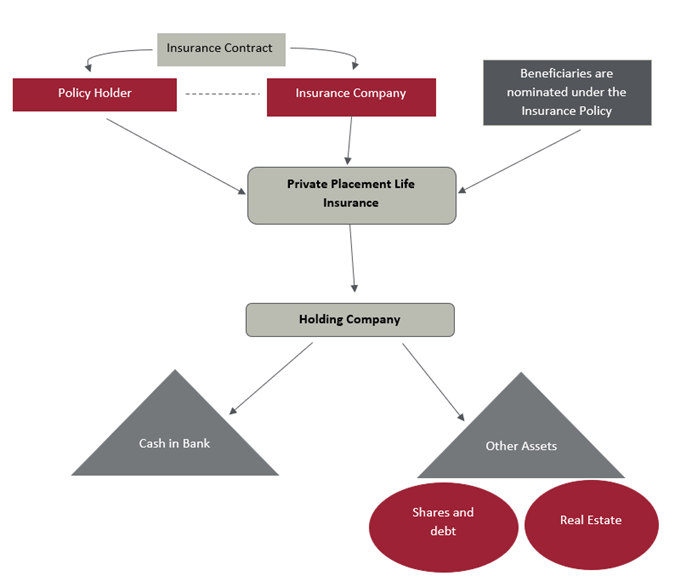

The insurance company and the policyholder enter into an insurance contract (the PPLI Policy) which sets out the terms and conditions on which the assets will be held and distributed. The PPLI Policy also includes the details of the policyholder, the life insured and the beneficiaries.

Upon execution of the PPLI Policy, the legal and beneficial title (full ownership) in the relevant assets is transferred to the insurance company making the insurance company the ultimate beneficial owner of the assets. The insurer will then place the underlying assets in a separate custody account, so the assets are segregated from the insurance company’s assets.

The assets are held by the insurance company until:

(a) the policy is surrendered by the policyholder, then the assets are transferred to the policyholder or such other person nominated by the policyholder; or

(b) the death of the insured person, then the assets are transferred to the beneficiaries. The beneficiaries can be one or several individuals, a company, a trust or a foundation.

Benefits of PPLI

(a) Confidentiality

The identity of the policyholder, beneficiaries and life insured remains confidential and allows wealthy families to keep their personal affairs private.

(b) Estate Planning

The policyholder has absolute discretion to elect beneficiaries (even from outside the family), and upon the death of the insured person, the beneficiaries will be paid within thirty days.

(c) Sharia Compliant

A PPLI can be designed to comply with Sharia law.

(d) Combination with other Succession Planning Options

Many clients have opted to combine PPLIs with other succession planning options that may be available. For example: (a) it is possible for the policyholder of a PPLI to be a private company or a trust, and (b) a trust can be nominated as a beneficiary of a PPLI.

As such, high-net-worth families can consider the use of a PPLI as an alternative structure when considering the different succession planning structures.

Should you require more information or have any other queries relating to PPLIs or other succession planning structures, please do not hesitate to contact Atiq Anjarwalla or Devvrat Periwal.